Date Published 17 October 2025

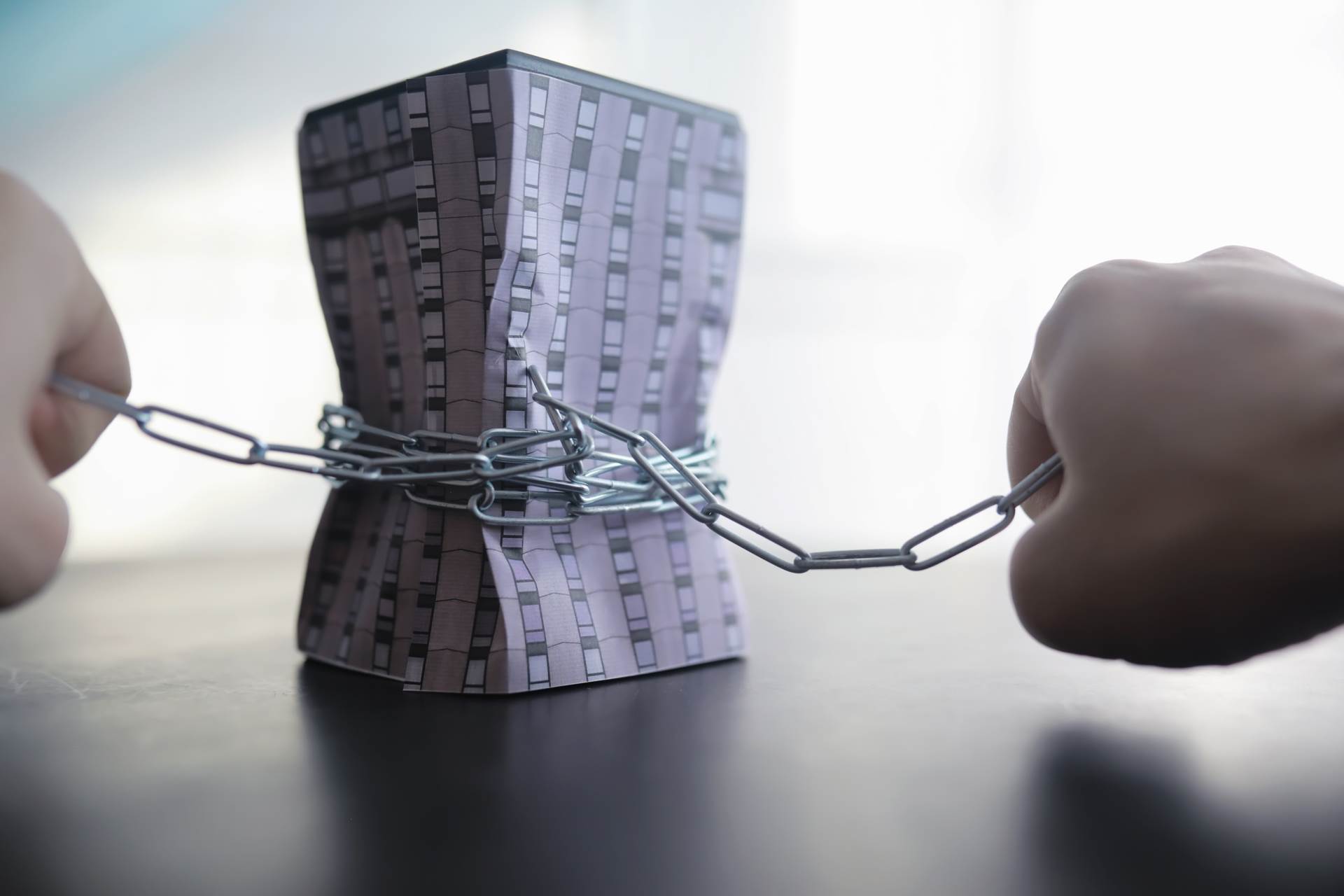

An influential think tank has warned Chancellor Rachel Reeves to avoid taking the 'simple' route of raising taxes such as National Insurance on landlord or investment income, and instead focus on long-overdue reform of the council tax system. The Institute for Fiscal Studies (IFS) cautioned that 'increasing taxes on returns to capital – such as rental income, dividend income, interest income, self-employment profits or capital gains – without broader reform would do more economic damage than is necessary.'

Instead, the IFS recommends what it calls 'proper reform' of property taxation, arguing that this would reduce disincentives to invest and ease the drag on economic growth created by the current system. 'Property taxation is an area in desperate need of reform,' the institute said. 'While additional revenue could be raised by increasing council tax across the board or targeting higher-value properties, these funds would initially go to local authorities rather than the Treasury.'

Moreover, the IFS added that the best long-term solution would be to replace the current council tax – still based on 1991 property valuations in England – with a reformed system or a new recurrent property tax proportional to up-to-date property values. It also suggested scrapping stamp duty land tax on housing, which it argues discourages people from moving, resizing, or investing in property, thereby hindering growth.

IFS director Helen Miller noted that Reeves's last Budget was 'full of tax increases,' leaving 'only losers,' and stressed that meaningful reform could create 'some winners' instead. 'If you take a reform approach,' Miller said, 'you can say you're doing something for a principled reason — to make the system fairer and more efficient. That means there's at least some good news to balance the inevitable upset from tax rises.'

As your trusted Agent, Adams Estates will continue to monitor any potential changes to National Insurance or wider tax regulations affecting landlords and investors.